Unlocking the Power of Fixed Income

Episode 8

Introduction to Interest Rates: Why Do They Matter for Bonds?

Introduction

Interest rates are one of the most important drivers of bond prices and yields. When the Reserve Bank of Australia (RBA) changes interest rates, it affects everything from government bond yields to corporate borrowing costs. Understanding this relationship is crucial for fixed-income investors.

In this episode, we’ll explore:

📌 How interest rates impact bond prices and yields

📌 The role of the RBA in setting Australia’s interest rate policy

📌 Why bond investors closely monitor rate movements

📌 How to position a bond portfolio in different rate environments

By the end, you’ll have a clear understanding of why interest rates are central to bond investing and how to manage interest rate risk effectively.

1. How Interest Rates Affect Bond Prices and Yields

There is a fundamental inverse relationship between interest rates and bond prices:

✔ When interest rates rise → Bond prices fall

✔ When interest rates fall → Bond prices rise

This happens because newly issued bonds will always adjust to offer yields in line with current interest rates, making existing bonds with lower coupon rates less attractive.

Example: The Impact of Changing Interest Rates on Bonds

Imagine you hold a 5-year bond paying a 4% coupon:

✅ Scenario 1: Interest Rates Rise to 5%

✔ Newly issued bonds now offer a 5% coupon, making your 4% bond less attractive.

✔ To remain competitive, the price of your bond falls so that it yields closer to 5% for new buyers.

✅ Scenario 2: Interest Rates Fall to 3%

✔ Newly issued bonds now offer a 3% coupon, making your 4% bond more valuable.

✔ As a result, your bond’s price increases in the secondary market.

💡 Key Takeaway: Bond prices adjust to ensure that investors receive a yield that aligns with the prevailing market interest rates.

2. The Role of the RBA in Interest Rate Policy

The Reserve Bank of Australia (RBA) plays a key role in setting the official cash rate, which influences all interest rates across the economy, including bond yields.

How the RBA Influences Interest Rates:

✔ Raising Rates – Used to control inflation, but increases borrowing costs and can reduce bond prices.

✔ Lowering Rates – Stimulates economic growth by making borrowing cheaper, boosting bond prices.

Example: The RBA's Interest Rate Cycle (2020-2023)

✔ 2020 – The RBA slashed interest rates to 0.10% to support the economy during the pandemic, boosting bond prices.

✔ 2022-2023 – As inflation surged, the RBA aggressively hiked rates above 4%, causing bond prices to fall sharply.

💡 Key Takeaway: The RBA’s monetary policy decisions have a direct impact on bond market movements, influencing both short-term and long-term rates.

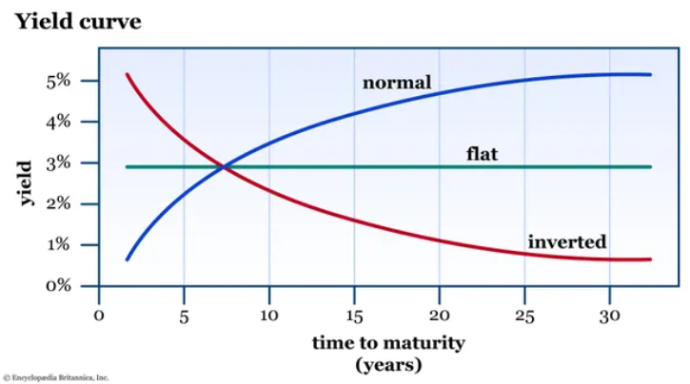

3. Yield Curves – What They Tell Investors About Interest Rates

A yield curve is a graphical representation of bond yields across different maturities. The shape of the yield curve provides insight into interest rate expectations and economic conditions.

Types of Yield Curves & What They Signal

✔ Normal Yield Curve – Long-term bonds have higher yields than short-term bonds, signaling economic growth.

✔ Flat Yield Curve – Short-term and long-term bonds have similar yields, indicating uncertainty.

✔ Inverted Yield Curve – Short-term bonds have higher yields than long-term bonds, often predicting a recession.

Example: The Australian Yield Curve in 2023

✔ The yield curve became inverted, signaling that investors expected economic slowdown due to high interest rates.

✔ Historically, inverted yield curves have preceded recessions, making them a key indicator for bond investors.

💡 Key Takeaway: Yield curves help investors understand market expectations for future interest rates and economic conditions.

Figure 1: Understanding Yield Curves – Normal, Flat, and Inverted

Figure 1 illustrates three key yield curve shapes—Normal, Flat, and Inverted—each reflecting different economic conditions. A normal yield curve slopes upward, indicating economic growth, where long-term bonds offer higher yields to compensate for inflation and risk. A flat yield curve suggests economic uncertainty, as short- and long-term yields converge, often signaling a transition in interest rate policy or slowing growth. An inverted yield curve, where short-term yields exceed long-term yields, is a warning sign of potential recession, as investors anticipate future rate cuts and weaker economic conditions. Yield curves serve as crucial indicators of market sentiment and economic expectations.

4. How Interest Rate Risk Affects Bonds

The sensitivity of a bond’s price to interest rate changes is known as duration risk.

Duration & Bond Price Sensitivity

✔ Shorter-duration bonds (1-3 years) are less sensitive to rate changes.

✔ Longer-duration bonds (10+ years) are more sensitive to rate changes.

Example: Comparing Bond Price Reactions to a 1% Rate Hike

✔ 2-Year Bond (Short Duration) – Price falls by 1-2%.

✔ 10-Year Bond (Long Duration) – Price falls by 8-10%.

💡 Key Takeaway: Long-term bonds are more exposed to interest rate risk than short-term bonds. Investors expecting rising rates should consider shorter-duration bonds or floating-rate securities.

5. Positioning a Bond Portfolio in Different Rate Environments

Understanding the interest rate cycle helps investors adjust their bond holdings to maximize returns and reduce risk.

How to Invest in Bonds Based on Interest Rate Trends:

✔ When Rates Are Falling → Long-term bonds benefit the most as their prices rise.

✔ When Rates Are Rising → Short-duration bonds and floating-rate securities are preferred to limit losses.

✔ When Rates Are Uncertain → A laddered bond strategy (holding bonds with staggered maturities) helps balance risk and return.

Example: Bond Portfolio Adjustments in 2023

✔ As rates rose sharply, many investors shifted to short-duration bonds to minimize interest rate risk.

✔ Some opted for inflation-linked bonds (TIBs) to protect against rising prices.

💡 Key Takeaway: Adapting bond portfolios based on interest rate expectations can enhance returns and reduce risk exposure.

📌 Final Takeaways: Why Interest Rates Matter for Bond Investors

✅ Interest Rates Drive Bond Prices – When rates rise, bond prices fall (and vice versa).

✅ The RBA Influences the Bond Market – Rate hikes and cuts impact yields across all maturities.

✅ Yield Curves Provide Insight – The shape of the yield curve signals economic expectations.

✅ Duration Risk Affects Volatility – Long-term bonds are more sensitive to rate changes.

✅ Portfolio Positioning is Key – Adjusting bond holdings based on interest rate cycles improves performance.

💡 Key Insight: Interest rates are the most important factor influencing bond performance. Smart bond investors monitor the rate cycle and adjust their portfolios accordingly.

📌 Coming Up Next…

Next, we’ll explore "Understanding Yield Curves and What They Tell Investors", covering:

✔ How different yield curve shapes impact bond strategies

✔ Why inverted yield curves often predict recessions

✔ How to use yield curve analysis in portfolio management

🔔 Stay tuned for more fixed-income insights! 🚀📈