Unlocking the Power of Fixed Income

Episode 7

The Australian Bond Market – Who Issues Bonds?

Introduction

Bonds are a crucial part of Australia’s financial system, helping governments, corporations, and financial institutions raise capital. Understanding who issues bonds and why they do so provides valuable insight for investors looking to navigate the Australian bond market.

In this episode, we’ll explore:

📌 The key issuers of bonds in Australia

📌 How the government, banks, and corporations raise capital through bonds

📌 The role of semi-government and supranational issuers in fixed income markets

📌 Where investors can access Australian fixed income investments

By the end, you’ll have a strong grasp of who drives the Australian bond market and how to incorporate domestic bonds into your investment strategy.

1. Australian Government Bonds (AGBs) – The Risk-Free Benchmark

Australian Government Bonds (AGBs) are issued by the Commonwealth Government to finance federal spending. They are considered the safest fixed-income securities in Australia due to the government’s ability to tax and print currency to meet debt obligations.

Why Investors Hold AGBs:

✔ Low Default Risk – Backed by the full faith of the Australian government.

✔ Stable Income – Regular interest (coupon) payments with minimal volatility.

✔ Highly Liquid – Easily traded on the ASX and over-the-counter markets.

Example: Commonwealth Treasury Bonds

✔ Treasury Bonds (Fixed Coupon Bonds) – Pay a set interest rate every six months until maturity.

✔ Treasury Indexed Bonds (TIBs) – Adjust both interest payments and principal based on inflation.

💡 Key Takeaway: AGBs provide a low-risk way for investors to preserve capital and earn predictable income. They serve as the benchmark for pricing other bonds in Australia.

2. State & Territory Government Bonds – Semi-Government Debt

State and territory governments issue semi-government bonds to fund infrastructure projects, public services, and economic development.

Why Consider Semi-Government Bonds?

✔ Higher Yields Than AGBs – Slightly higher risk than federal bonds, offering better returns.

✔ Strong Credit Quality – Backed by stable, revenue-generating state governments.

✔ Diversification – Provides exposure to regional Australian economies.

Example: Australian State Government Bonds

✔ New South Wales Treasury Corporation (TCorp) Bonds – Used to fund transport and education projects.

✔ Queensland Treasury Corporation (QTC) Bonds – Helps finance public utilities and state infrastructure.

✔ Treasury Corporation of Victoria (TCV) Bonds – Supports Victoria’s economic development.

💡 Key Takeaway: Semi-government bonds offer a balance between safety and higher yields, making them a popular choice for income-seeking investors.

3. Corporate Bonds – Higher Yield, Higher Risk

Corporate bonds are issued by Australian companies to raise funds for business expansion, acquisitions, or refinancing debt.

Types of Corporate Bonds:

✔ Investment-Grade Corporate Bonds (AAA to BBB-) – Issued by stable companies like the major banks and blue-chip corporations.

✔ High-Yield (Junk) Bonds (BB+ and below) – Issued by riskier companies offering higher yields to attract investors.

Example: Investment-Grade vs. High-Yield Bonds

✔ Commonwealth Bank Bonds (A-rated) – Lower risk, lower yield, steady income.

✔ Virgin Australia Bonds (BB-rated, prior to administration) – Higher yields, but greater risk, ultimately leading to losses when the company went into voluntary administration.

💡 Key Takeaway: Corporate bonds provide higher returns than government bonds, but investors must assess credit risk carefully when selecting issuers.

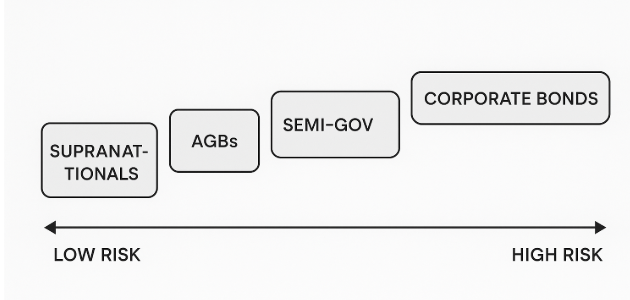

Figure 1: The Australian Bond Issuer Spectrum — Risk vs. Yield

This figure illustrates where different bond issuers sit on the risk-return spectrum, from low-risk supranationals and Australian Government Bonds (AGBs), to higher-yielding but riskier corporate bonds. Understanding this hierarchy helps investors align their fixed-income choices with their risk tolerance and return objectives.

4. Financial Institutions – Bank-Issued Bonds

Australia’s Big Four banks (Commonwealth Bank, NAB, ANZ, and Westpac) and other financial institutions issue bonds to fund lending activities and maintain regulatory capital requirements.

Common Types of Bank Bonds:

✔ Senior Bonds – Higher in the capital structure, relatively lower risk.

✔ Subordinated Bonds – Higher yields but increased risk of losses in case of default.

✔ Hybrid Securities & Convertible Bonds – Bonds with equity-like features, such as conversion into shares under certain conditions.

💡 Key Takeaway: Bank bonds offer competitive yields and strong credit ratings, but hybrid securities can be riskier due to their equity-like nature.

5. Supranational Bonds – Global Institutions Raising Capital

Supranational bonds are issued by international financial institutions such as the World Bank, Asian Development Bank (ADB), and the International Finance Corporation (IFC) to fund global projects.

Why Consider Supranational Bonds?

✔ High Credit Quality – Issued by multinational institutions with strong backing.

✔ Ethical & Sustainable Investing – Many support infrastructure, sustainability, and economic development projects.

✔ Global Diversification – Offers exposure to international debt markets.

Example: Supranational Bonds in Australia

✔ World Bank AUD Bonds – Issued in Australian dollars, eliminating currency risk.

✔ ADB Sustainable Bonds – Used to finance clean energy and social infrastructure projects.

💡 Key Takeaway: Supranational bonds are ideal for investors seeking low-risk global exposure while supporting sustainable initiatives.

6. Where Investors Can Access the Australian Bond Market

Australian investors can access bonds through multiple channels, depending on their level of experience and investment size.

Ways to Invest in Bonds:

✔ Australian Stock Exchange (ASX) – ASX-listed government and corporate bonds allow direct investment with relatively small capital requirements.

✔ Over-the-Counter (OTC) Bond Market – Wholesale bond market for institutional investors and high-net-worth individuals.

✔ Bond ETFs & Managed Funds – Provides easy access to diversified bond portfolios with lower entry requirements.

💡 Key Takeaway: Retail investors can access bonds via the ASX, while institutional and high-net-worth investors may prefer the OTC market for greater flexibility.

📌 Final Takeaways: Understanding the Australian Bond Market

✅ Government Bonds (AGBs) – Risk-free investments that provide stability.

✅ Semi-Government Bonds – Higher yields than AGBs, with strong credit quality.

✅ Corporate Bonds – Offer higher yields but carry credit risk.

✅ Bank-Issued Bonds – Commonly used for fixed-income investing with strong credit ratings.

✅ Supranational Bonds – Low-risk global exposure with sustainable investment opportunities.

✅ Bond Market Access – ASX, OTC, and ETFs provide multiple entry points for investors.

💡 Key Insight: The Australian bond market is diverse, offering investment opportunities across various issuers and risk levels. A balanced bond portfolio should align with your investment goals, risk tolerance, and market outlook.

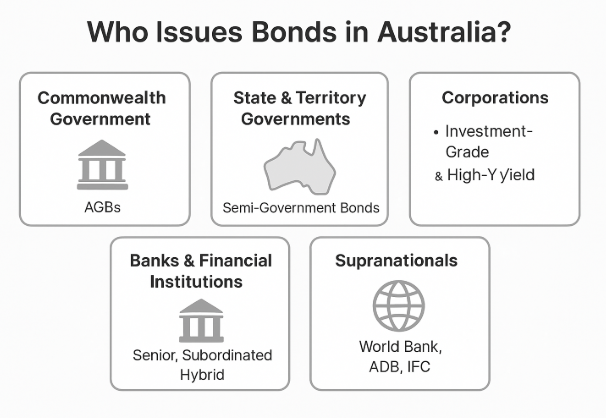

Figure 2: Who Issues Bonds in Australia?

This grayscale diagram presents the five key bond issuers in Australia—Commonwealth Government, State & Territory Governments, Corporations, Banks & Financial Institutions, and Supranationals—in a clean, visual layout. Each issuer is represented by a labeled box with a simple icon and description, highlighting their role in the fixed-income market. From low-risk Australian Government Bonds (AGBs) to higher-yielding corporate and bank-issued bonds, and globally backed supranational debt, the figure offers a concise snapshot of the diverse participants shaping Australia's bond landscape.

📌 Coming Up Next…

Next, we’ll explore "Introduction to Interest Rates: Why Do They Matter for Bonds?", covering:

✔ How RBA interest rate decisions impact bond yields

✔ Why interest rates drive bond prices

✔ How to position a bond portfolio in different rate environments

🔔 Stay tuned for more fixed-income insights! 🚀📈