Unlocking the Power of Fixed Income

Episode 3

How Bonds Work – Coupon, Yield, and Maturity

Introduction

Bonds are one of the most reliable investment vehicles, offering predictable income and capital preservation. However, understanding the mechanics of bonds is crucial to unlocking their full potential.

In this episode of the Gilt Blog Series, we’ll dive into:

✔ Coupon payments – How bonds generate income.

✔ Bond yield calculations – Understanding current yield vs. yield to maturity (YTM).

✔ Maturity structures – How different bond terms impact risk and return.

✔ The role of reinvestment – Why achieving YTM requires active coupon management.

By the end of this article, you’ll have a clear understanding of how bonds generate returns and why reinvestment plays a crucial role in fixed-income investing.

1. Understanding Coupon Payments

The coupon rate is the annual interest paid by the bond issuer to the bondholder, expressed as a percentage of the bond’s face value (par value).

📌 Example:

- A $1,000 bond with a 5% coupon rate pays $50 per year in interest.

- Most Australian bonds pay semi-annual coupons, meaning the investor receives $25 every six months.

Types of Coupon Structures

✔ Fixed Coupon Bonds – Pay a set interest rate for the life of the bond.

✔ Floating Rate Bonds – Adjust their coupon based on an interest rate benchmark (e.g., the RBA cash rate).

✔ Zero-Coupon Bonds – No periodic interest; issued at a discount and redeemed at face value at maturity.

💡 Why It Matters:

- Higher coupon rates provide more frequent income, but don’t always mean a higher return.

- Zero-coupon bonds are highly sensitive to interest rate changes since all returns come from price appreciation.

2. Yield – Understanding Bond Returns

A. Current Yield vs. Yield to Maturity (YTM)

The current yield is the annual income generated from a bond based on its current market price.

Current Yield=Annual Coupon PaymentMarket Price of the Bond×100\text{Current Yield} = \frac{\text{Annual Coupon Payment}}{\text{Market Price of the Bond}} \times 100Current Yield=Market Price of the BondAnnual Coupon Payment×100

🔹 Example:

- A bond with a $50 annual coupon trading at $1,000 has a current yield of 5%.

- If the bond price drops to $900, the current yield increases to 5.56%.

B. Yield to Maturity (YTM) – The True Return of a Bond

YTM is the total return an investor will earn if they hold the bond until maturity, factoring in:

✔ Coupon payments

✔ Capital gains or losses (if the bond was purchased at a discount or premium)

✔ Time remaining until maturity

The Crucial Assumption of YTM

⚠ YTM assumes that all coupon payments are reinvested at the same yield rate until the bond matures.

🚨 Why This Is Important:

- Reinvestment risk exists because interest rates fluctuate. If rates fall, reinvested coupons may earn less than the prevailing YTM.

- To achieve the stated YTM, an investor must actively reinvest coupons at the same YTM rate—which is rarely possible in reality.

📌 Example – The Impact of Reinvestment:

Consider a 10-year bond with:

- Face value: $1,000

- Coupon rate: 5% ($50/year)

- YTM at purchase: 6%

Scenario 1 – Perfect Reinvestment:

✔ If all $50 coupons are reinvested at 6%, the investor earns the stated YTM of 6%.

Scenario 2 – Lower Reinvestment Rate:

⚠ If interest rates drop to 3%, reinvested coupons generate less income, reducing the actual return below 6%.

💡 Investor Takeaway:

Achieving YTM in real life requires active coupon reinvestment. If interest rates fall, the investor may earn less than the advertised YTM.

3. Maturity – The Bond’s Lifespan & Risk Implications

The maturity date is when the issuer repays the bondholder the face value of the bond.

A. Types of Bonds by Maturity Length

🔹 Short-Term Bonds (1-3 years) – Lower risk, but lower yields.

🔹 Medium-Term Bonds (3-10 years) – Moderate risk and return.

🔹 Long-Term Bonds (10+ years) – Higher yields but greater sensitivity to interest rate changes.

B. Why Longer Maturities Carry More Risk

✔ Higher Interest Rate Risk – Long-term bonds are more affected by rate changes.

✔ More Uncertainty – Inflation, credit events, and economic cycles impact long-term bonds more than short-term ones.

✔ Better for Income, Riskier for Capital Gains – If you’re holding for income, longer maturities can be attractive. If trading bonds, short maturities may be more predictable.

📌 Example:

- If interest rates rise by 1%, a 30-year bond’s price drops much more than a 5-year bond due to duration effects.

- Investors needing stability in rising rate environments should reduce duration by choosing shorter-term bonds or floating-rate notes.

4. Why Do Bond Prices Fluctuate?

Bond prices aren’t static—they respond to market forces, including:

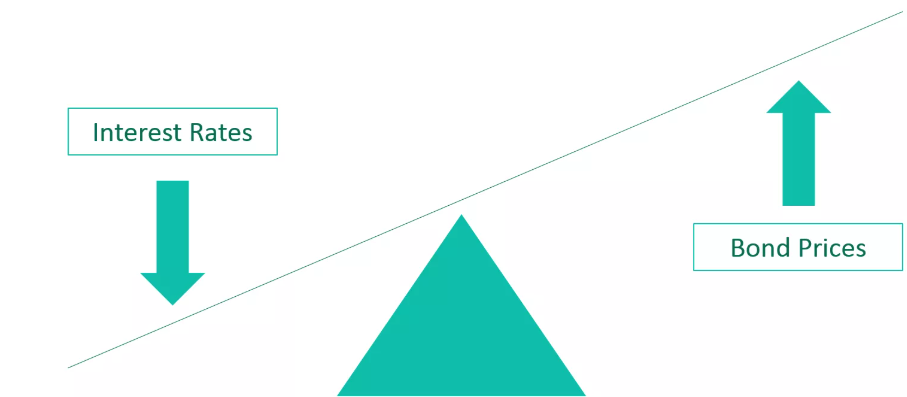

📌 Interest Rate Movements (Refer to Figure 1)

✔ When interest rates rise, bond prices fall.

✔ When interest rates fall, bond prices increase.

📌 Credit Risk

✔ If an issuer’s credit rating is downgraded, bond prices drop.

✔ High-rated bonds (AAA) are more stable than junk bonds.

📌 Inflation Expectations

✔ Higher inflation erodes purchasing power, making bonds less attractive.

✔ Inflation-linked bonds (TIBs) help mitigate this risk.

📌 Liquidity & Market Demand

✔ Bonds with low trading volume may have wider bid-ask spreads.

✔ Government bonds are highly liquid, while corporate bonds vary in liquidity.

Figure 1: The figure illustrates the inverse relationship between bond prices and interest rates using a seesaw analogy. As interest rates decrease (represented by the downward arrow on the left), bond prices increase (represented by the upward arrow on the right). This occurs because when new bonds are issued at lower interest rates, existing bonds with higher fixed coupon payments become m

ore valuable, increasing their market price. Conversely, if interest rates were to rise, bond prices would fall as newer bonds offering higher yields would be more attractive to investors. This fundamental concept is crucial in fixed-income investing, as it affects bond valuation, portfolio management, and interest rate risk considerations.

Key Takeaways – Making Smart Bond Investments

✅ Coupon payments provide stable income, but reinvestment is key to maximizing returns.

✅ YTM is a powerful metric—but requires active coupon reinvestment to be realized.

✅ Bond maturity affects risk—longer bonds have higher duration risk, while short-term bonds are more stable.

✅ Interest rates & credit risk impact bond prices—diversification across maturities helps manage risk.

Coming Up Next…

In our next episode, we’ll explore:

📌 "Understanding Bond Pricing: Why Do Bond Prices Fluctuate?" – A deep dive into how interest rates, credit ratings, and market conditions drive bond prices.

🔔 Stay tuned for more insights into fixed-income investing!